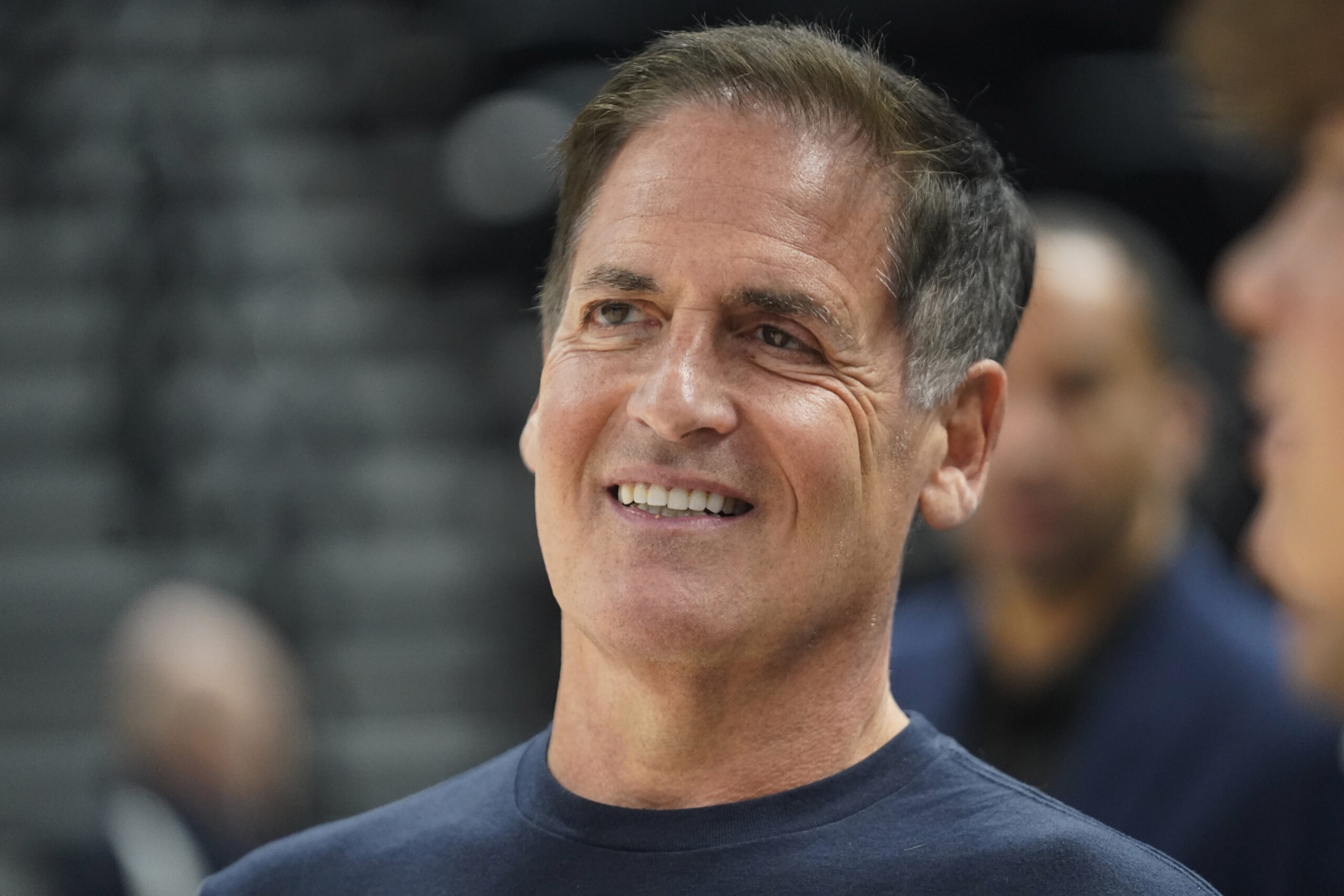

Mark Cuban Schools California Democrat On Trump’s Financial Situation: ‘You Are Wrong On This’

AP Photo/Rick Bowmer

Billionaire businessman and Shark Tank personality Mark Cuban schooled Rep. Ted Lieu (D-CA) on Tuesday after the California Democrat suggested Donald Trump isn’t really a billionaire because he can’t pay his legal judgements.

“Trump claims he is a billionaire. But he can’t pay a $464 million judgement. That means he is lying. How do I know? Math,” wrote Lieu on X Tuesday, while sharing a news report on Trump telling the court he can’t post a bond to defer paying the full judgment.

Cuban replied to Lieu and offered a quick economics lesson as to why Trump doesn’t have half a billion dollars in cash on hand, despite being a billionaire.

“Ted, you know I’m no supporter of Trump. That’s for damn sure,” began Cuban, who recently said he would vote for President Joe Biden over Trump, even if Biden were on his death bed.

“How anyone can vote for someone who has so many of his executive employees turn on him, and, say he is incompetent is beyond me,” Cuban continued, adding:

But you are wrong on this topic Ted.

Net worth is completely different than cash in the bank.

We were in a zero interest rate environment for a long, long time. So keeping cash in the bank or even money markets was dumb. In fact searching for yield is what killed small banks last year.

Also dumb was keeping interest rates that low for that long. Something Trump demanded more of.

So you can argue that trump put himself in this situation by making sure that the only way to grow his net worth was non cash investments.

You can also argue Trump sucked at growing his net worth which led to him putting himself in this position by lying to banks about his assets. There is only one reason to lie on a loan application – you have to.

On a more macro basis Ted. Even if rates were along a long term trend line for the past ten years, few people are keeping more than 45 percent of their assets in liquid assets.

And as far as the bond companies Trump’s assets are mostly interests in commercial real estate and foreign assets. No bond company is loaning against them in this commercial real estate market, if ever.

Read Cuban’s tweet here.

Have a tip for us? tips@mediaite.com